An Unbiased View of Frost Pllc

Table of ContentsRumored Buzz on Frost PllcFrost Pllc Can Be Fun For AnyoneFrost Pllc Things To Know Before You Get ThisAbout Frost PllcHow Frost Pllc can Save You Time, Stress, and Money.

CPAs are amongst one of the most trusted occupations, and completely factor. Not only do CPAs bring an unmatched degree of expertise, experience and education to the process of tax planning and managing your money, they are especially educated to be independent and unbiased in their job. A certified public accountant will certainly aid you protect your passions, pay attention to and resolve your problems and, equally important, give you peace of mind.Employing a local Certified public accountant company can positively affect your service's economic health and wellness and success. A regional CPA company can assist decrease your business's tax obligation concern while guaranteeing conformity with all suitable tax regulations.

This development reflects our devotion to making a favorable effect in the lives of our clients. Our dedication to excellence has actually been recognized with numerous awards, consisting of being named among the 3 Best Bookkeeping Companies in Salt Lake City, UT, and Best in Northern Utah 2024. When you deal with CMP, you become component of our family.

The Facts About Frost Pllc Uncovered

Jenifer Ogzewalla I've dealt with CMP for numerous years currently, and I've really valued their competence and performance. When auditing, they function around my schedule, and do all they can to maintain continuity of personnel on our audit. This saves me time and power, which is very useful to me. Charlotte Cantwell, Utah Festival Opera & Music Theatre For a lot more motivating success stories and responses from business owners, click here and see exactly how we've made a difference for companies like your own.

Right here are some key concerns to lead your decision: Inspect if the certified public accountant holds an active permit. This assures that they have actually passed the required tests and fulfill high ethical and expert criteria, and it reveals that they have the qualifications to handle your economic issues responsibly. Verify if the certified public accountant supplies services that align with your service demands.

Little companies have special monetary requirements, and a CPA with appropriate experience can offer more tailored advice. Ask concerning their experience in your sector or with organizations of your dimension to ensure they recognize your details obstacles.

Make clear just how and when you can reach them, and if they use routine updates or assessments. An easily accessible and responsive CPA will certainly be very useful for prompt decision-making and support. Employing a local certified public accountant company is greater than simply contracting out monetary tasksit's a smart financial investment in your service's future. At CMP, with offices in Salt Lake City, Logan, and St.

Frost Pllc Things To Know Before You Get This

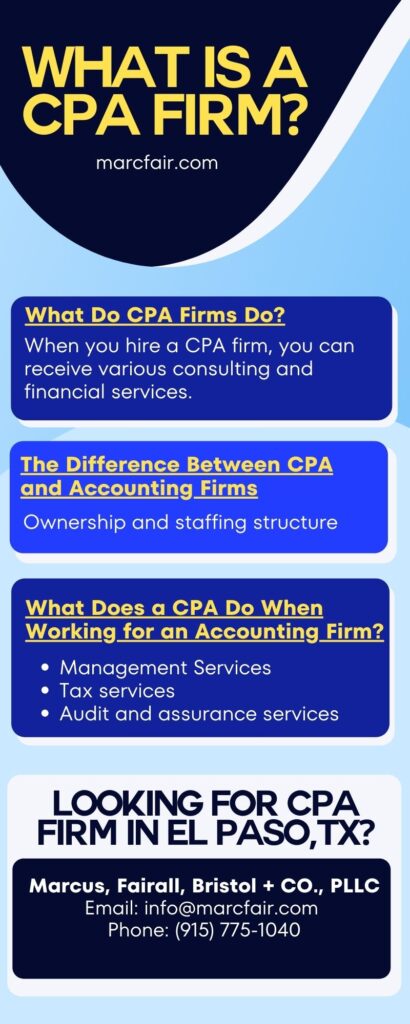

An accounting professional who has actually passed the certified public accountant exam can represent you prior to the internal revenue service. CPAs are accredited, accounting experts. Certified public accountants might help themselves or as component of a click to read firm, relying on the setting. The price of tax obligation preparation might be reduced for independent professionals, but their proficiency and capacity may be less.

Frost Pllc Fundamentals Explained

Handling this responsibility can be a frustrating job, and doing something incorrect can cost you both economically and reputationally (Frost PLLC). Full-service CPA companies are familiar with declaring demands to ensure your business follow federal and state laws, along with those of banks, investors, and others. You might need to report extra income, which might require you to submit an income tax return for the initial time

team you can trust. Call us for more info about our solutions. Do you recognize the bookkeeping cycle and the actions associated with making certain proper monetary oversight of your organization's financial health? What is your business 's legal framework? Sole proprietorships, C-corps, S corporations and partnerships are taxed in different ways. The even more complex your income resources, venues(interstate or international versus regional )and sector, the more you'll need a CERTIFIED PUBLIC ACCOUNTANT. Certified public accountants have more education and learning and undergo an extensive accreditation process, so they set you back even more than a tax preparer or bookkeeper. Usually, tiny businesses pay between$1,000 and $1,500 to employ a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this expenditure might beunreachable. The months gross day, April 15, are the busiest time of year for CPAs, complied with by the months before the end of the year. You may have to wait to obtain your inquiries answered, and your tax return might take longer to finish. There is a limited number of CPAs to go around, so you might have a difficult time discovering one particularly if you've waited up until the eleventh hour.

Certified public accountants are the" huge guns "of the bookkeeping industry and usually do not manage day-to-day accountancy tasks. Usually, these other kinds of accountants have specializeds across locations where having a CPA certificate isn't needed, such as monitoring accountancy, not-for-profit bookkeeping, price accountancy, federal government accountancy, or audit. As an outcome, utilizing an accounting solutions firm is commonly a much better worth than working with a CPA

firm to company your sustain financial continuous economic.

Certified public accountants additionally have knowledge in establishing and improving business policies and procedures and assessment of the functional needs of staffing models. A well-connected CPA can leverage their network to assist the company in numerous critical and getting in touch with duties, properly attaching the organization to the suitable prospect to meet their requirements. Next time you're looking to fill a board seat, consider getting to out to a Certified public accountant that can bring value to your organization in all the ways listed above.